Recent News & Blog / New for 2020: Tax Form 1099-NEC

January 7, 2021

January 7, 2021

By: Kevin B. Stouffer, CPA - Member of the Firm

Mandy L. Walls - Senior Associate

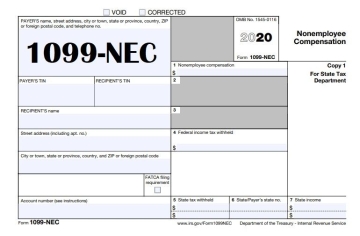

The Internal Revenue Service (IRS) has released the 2020 Form 1099-NEC, which will impact governmental entities’ reporting for nonemployee compensation. This new form replaces Form 1099-MISC for reporting the nonemployee compensation (Box 7), shifting the role of the 1099-MISC for reporting all other types of compensation. Below is a summary of the changes, so you know what to expect and how to handle the forms appropriately.

The new 1099-NEC (NEC stands for nonemployee compensation) is based on an old form that has been out of use since 1982. The critical component of this reporting is determining what is considered nonemployee compensation. Previously reported in Box 7 of the 1099-MISC, the new 1099-NEC will capture any payments to nonemployee service providers, such as independent contractors, freelancers, vendors, consultants, and other self-employed individuals (commonly referred to as 1099 workers).

According to the IRS, a combination of these four conditions distinguishes a reportable payment:

- It is made to someone who is not your employee

- It is made for services in the course of your government operations

- It is made to an individual, partnership, estate, or in some cases, a corporation

- Payments were $600 or more for the calendar year

Typical examples include professional service fees to attorneys (including law firms established as corporations), accountants, engineers, architects, and payments for services, including payment for parts or materials used to perform the services if they were incidental.1099-NEC will also be used for fees to independent contractors as well as vehicle and mileage reimbursements to nonemployees.

Exceptions include payments for merchandise, telegrams, phone, freight, storage, or similar items and payments to tax-exempt organizations, including tax-exempt trusts, as well as federal, state, and local governments.

When completing the 1099-NEC, it is important to verify that the recipient’s taxpayer information is correct. New vendors should complete a Form W-9 to confirm proper reporting of taxpayer name, address, and tax ID (existing vendors should be reviewed periodically for any changes as well). Form 1099-NEC should not be used to report employee wages, as Form W-2 should be used instead.

When it comes to completing and submitting the Form 1099-NECs, the timing is slightly different than for 1099-MISC forms. Form 1099-NEC is required to be distributed to vendors and submitted to the IRS by January 31 (for 2021, the due date is February 1 since January 31 falls on a Sunday). Form 1099-MISC should be distributed to vendors by January 31 (February 1 for 2021 reporting) and submitted to the IRS by March 1 (or March 31 if filing electronically). For the year 2020, the electronic filing threshold is 100 forms, which means any governmental entity with 100 forms or more is required to e-file.

Please contact us if you have questions about this new form or need clarification. We are here for you!