Being a gig worker comes with tax consequences

In recent years, many workers have become engaged in the “gig” economy. You may think of gig workers as those who deliver take-out restaurant meals, walk dogs and drive for ride-hailing services. But so-called gig work seems to be expanding.

The IRS has just announced 2024 amounts for Health Savings Accounts

The IRS recently released guidance providing the 2024 inflation-adjusted amounts for Health Savings Accounts (HSAs). HSA fundamentals

If you’re married, ensure that you and your spouse coordinate your estate plans

Estate planning can be complicated enough if you don’t have a spouse. But things can get more difficult for married couples.

Keep thieves from stealing from your nonprofit youth sports league

A few years ago, the popular and well-compensated executive director of a west coast youth soccer league was accused of fraud. After scrutinizing the club’s books, the league’s board of directors couldn’t account for $80,000.

4 tax challenges you may encounter if you’re retiring soon

Are you getting ready to retire? If so, you’ll soon experience changes in your lifestyle and income sources that may have numerous tax implications. Here’s a brief rundown of four tax and financial issues you may contend with when you retire:

You’ve received a sizable inheritance: Now what?

If you’ve received, or will soon receive, a significant inheritance, it may be tempting to view it as “found money” that can be spent freely.

Should you reassess your nonprofit’s office space?

Since the original COVID-19 lockdowns, many not-for-profits have allowed their staffers to work from home — or work a hybrid schedule that puts them onsite only part time. This can leave a lot of office space unused.

Questions you may still have after filing your tax return

If you’ve successfully filed your 2022 tax return with the IRS, you may think you’re done with taxes for another year. But some questions may still crop up about the return. Here are brief answers to three questions that we’re frequently asked at this time of year.

How to use QuickBooks as a fraud detection tool

Many businesses and nonprofits use QuickBooks® as a cost-effective solution to manage their accounting processes. However, the software’s capabilities extend beyond organizing and streamlining your company’s accounting. QuickBooks can also help you detect fraud.

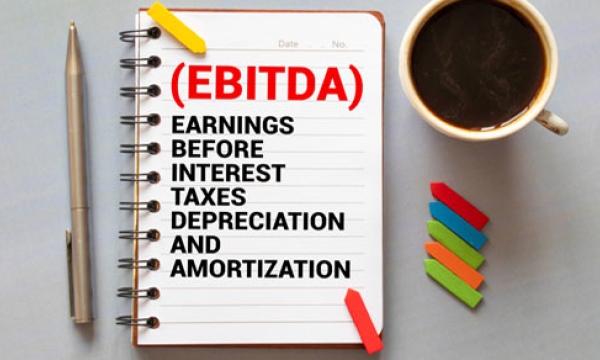

Reporting non-GAAP measures

Generally Accepted Accounting Principles (GAAP) is generally considered the gold standard in financial reporting in the United States. But private and public entities may sometimes use non-GAAP metrics in their disclosures and press releases or when applying for financing.