Recent News & Blog / Get Ready to Reconcile in QuickBooks Online

October 27, 2025

Putting it off isn’t the answer. That just makes it harder. Here’s how to prepare for account reconciliation.

Reconciling bank accounts is probably one of your five least favorite financial chores. It takes time, takes precision, and it seems like you can never get the difference between those two final numbers down to zero, so, it’s easy to just not do it. I’ll just check my bank balance regularly, you tell yourself.

Bank account reconciliation is about a lot more than simply preventing overdrafts. True, that’s one of its benefits, but there are others. You’ll be able to:

- Make sure no one has accessed your accounts without authorization,

- Detect errors before they cause major problems,

- Verify that your bill payments have cleared your vendors’ accounts, and,

- Match incoming payments to invoices you’ve sent.

If you’re still working with paper checkbook registers to reconcile, you’ll find that QuickBooks Online makes this process at least somewhat easier, less time-consuming, and, ultimately, more accurate. Here are the things you should do before you attempt the actual process of reconciliation.

Make sure you’ve set up all your account connections in QuickBooks Online.

You’ve undoubtedly noticed that Intuit has changed the main QuickBooks Online user interface and navigation tools rather dramatically. Learning the new system can take some time, and you may have to just click around a lot until you find what you’re looking for. There’s more than one way to get to some of the pages you want, and we can help if you’re totally lost.

You’re probably already connected to at least some of your financial accounts so you could import transactions. If not, here’s how to do so.

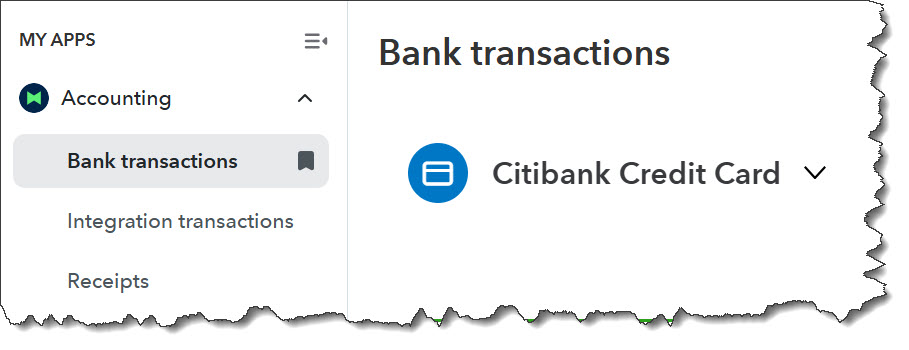

You’ll now find Bank transactions in My Apps. You’ll start here when you’re connecting to a new financial account.

With the Dashboard open (left toolbar), click the Accounting “App” in the upper left. Click Bank transactions in the list that opens. Click Link account on the right side of the page. If your bank appears in the list that comes up, click it. Otherwise, you can enter its name or sign-in URL in the search box at the top. Follow the instructions for your specific bank and account to make the connection and start importing transactions.

Update your QuickBooks Online data as thoroughly as you can.

QuickBooks Online updates your imported account transactions on its own sometimes. Before you reconcile, do a manual refresh. Go to the Accounting App again, to the Bank transactions page. Click Update in the upper right.

Add any missing data to QuickBooks Online. Have you forgotten to document payments, for example? Wrote a paper check and didn’t enter it on the site? Made a bank deposit and neglected to put it in QuickBooks Online?

If you import transactions, make sure you’ve gone through all the ones that have cleared and marked them so. This is something you should be doing every time you open QuickBooks Online but check again before reconciling. Again, you’ll be working on the Bank transactions page. You may notice that the “new” version of the site does a better job of guessing at transaction categories but check them for accuracy and change them if they’re not the best option.

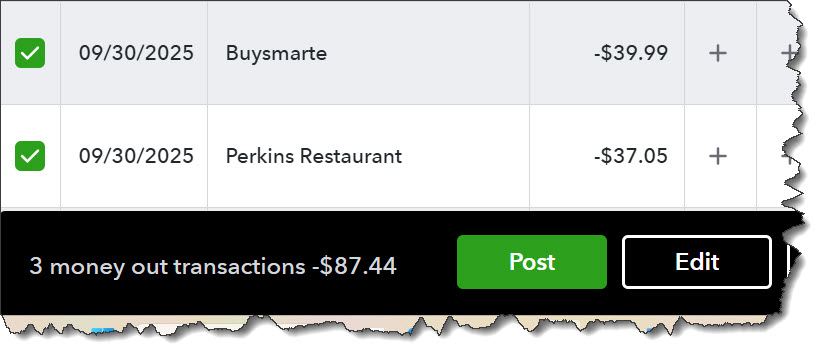

Click the Match button at the end of a row if you think QuickBooks Online has found an invoice that matches a payment, for example. Click the transaction itself to see all your options there. When you’re satisfied that all the transaction’s details are correct, click the box in front of it. You’ll see a panel like the one pictured below. Click Post to move it into the Posted list.

Before you reconcile an account, go through the list of transactions in the Pending list and Post as many as you can.

Organize your tax-related documents.

As you’re preparing to do your monthly reconciliation, make it a habit to use this time to make sure you have all the paper backup you’ll need when it’s time to prepare your income taxes. If you haven’t already, get some folders or large envelopes and organize them by month or Schedule C category, like meals and entertainment, office supplies, and car and truck expenses. Don’t forget proof of income. This paper can include:

- Paper receipts (get in the habit of making notes on them if they’re not self-explanatory),

- Credit card statements,

- Printouts from digital bookkeeping, like scanned receipts,

- Pay stubs, and,

- Bank statements.

You won’t have to turn this paper in with your income tax return, of course, but keep it in a safe place for at least three years.

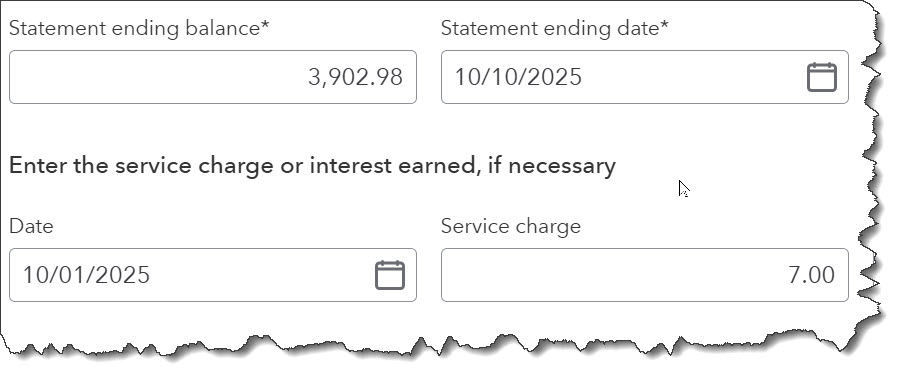

Don’t forget about bank charges.

Even if you don’t pay much attention to them, bank charges must be included when you reconcile your accounts.

QuickBooks Online allows you to import a statement before you start reconciling (optional). The site then uses AI-powered tools to assist in the process.

We wish we could tell you that QuickBooks Online makes reconciliation painless. It doesn’t. Once all transactions have been matched and cleared, you may still end up with a Difference that is a number other than zero, which it should be. We suggest you let us take you through this process for at least the first time. We can even take over your monthly reconciliation duties.

It’s much easier for us to do that than to try to untangle accounts that have not been reconciled—or reconciled correctly—for months. Contact us, and we’ll come up with a plan that works for you.

Be sure to sign up for our monthly QuickBooks newsletter for the latest updates: