Recent News & Blog / How progress invoicing can improve your cash flow

August 4, 2025

If you’re concerned about your company’s cash flow because you don’t know what will happen with the U.S. economy in the coming months, you’re not alone. The vast majority of small businesses struggle with cash flow -- all the time. Are you making more than you’re spending? Will that change six weeks or three months from now?

We don’t have a crystal ball that will help you answer that question. But we do have QuickBooks Online. Besides providing predictive charts that can assist you in looking at future cash flow trends, the site offers a tool that can help you take concrete steps to actually improve your cash flow in the near future.

If you send out estimates and/or do multi-part projects for your customers, you can create progress invoices. These modified invoices allow you to send partial bills. You can break up your product and service costs into smaller pieces and start getting paid sooner than you would if you waited until your work was complete. Here’s how it works.

Readying QuickBooks Online

Before you get started, check to make sure QuickBooks Online will accommodate these modified invoices. Click the gear icon in the upper right and click Account and settings under YOUR COMPANY. Scroll down and click Sales, then scroll down in the right pane until you see Progress Invoicing. Make sure this option is turned On. Click Done in the lower right corner.

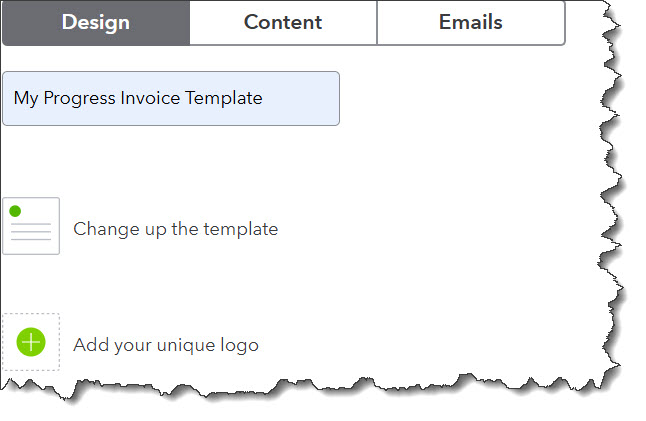

Creating A New Template

Now you have to modify the invoice template to accommodate progress invoicing. Click the gear icon in the upper right again and then click Custom form styles under YOUR COMPANY. Open the New style menu in the upper right and select Invoice. Your default template will appear in the box under Design/Content/Emails. Replace that name with a new descriptive name so you don’t overwrite your default invoice settings. Click Change up the template.

You’ll have to change the name of the default invoice template so you can modify it to use as a progress invoice.

Select Airy new in the box of options that opens. You can now modify the design of your new template by, for example, adding a logo. Click When in doubt, print it out to see your print options. Next, click the Content tab. You’ll see a grayed-out version of your template in the right pane. Click any of the template sections, and the corresponding fields will appear in the left pane. You can modify these as needed, then move on to the next. When you’re satisfied with the template, click the Emails tab and make any changes necessary there. Finally, you can Preview PDF by clicking the link in the lower right corner. Click Done when you’re finished.

You’ll be returned to the Custom form styles page, where you’ll see your new template in the list. Pay attention to which template says (default) in the FORM TYPE column. This is the template that will automatically open when you’re creating a new form (you can change this on the fly). You can designate a new default by opening the Edit menu in the last column.

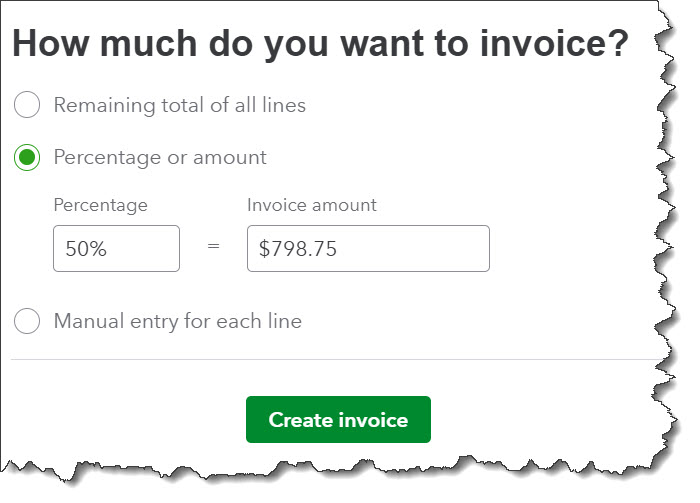

Creating A Progress Invoice

When you have an estimate that you want to start billing (even though you haven’t completed all the work or purchased all the products needed), locate the estimate in the Estimates list. Click Convert to invoice at the end of the row. A window opens, asking how much you want to invoice. Your options are:

- Remaining total of all lines

- Percentage or amount

- Manual entry for each line

You have three options when you’re creating a progress invoice.

You would choose the first option if you’ve already partially processed the invoice and are ready to close it out. The second option allows you to just enter a flat percentage of the invoice total to include. If you choose the third, the invoice that opens will have zeroes in the Due column.

You can alter the amount due for any of these by either a percentage or an amount, and/or leave them at zero if you don’t want to bill a particular product or service. Either way, the Balance due will reflect your changes. When you’ve come to the last invoice for the project, you’ll check Remaining total of all lines.

When you’re done, just process the invoice like you would a standard form. You can always see an accounting of your progress invoices by running the Estimates & Progress Invoicing Summary by Customer Report.

Other Routes to Better Cash Flow

Of course, there are other ways you can improve your cash flow. We’ve gone over them before and explained how QuickBooks Online accommodates them. You can, for example:

- Offer modest discounts for early payment,

- Apply finance charges to late payments,

- Send invoices immediately and consider altering your terms (like 15 days instead of 30 days),

- Look for inventory items that aren’t moving fast and sell them off with a sale, and,

- Send reminders for late payments and follow up if they’re not settled quickly.

Progress invoicing benefits both you and your customers. And in these challenging economic times, everyone needs a break. Let us know if you have questions about managing estimates and invoices in QuickBooks Online. We’re here if you need us.