Recent News & Blog / Keep your vendors happy: Tracking bills in QuickBooks Online

September 30, 2025

If only I had more income, you may think to yourself when you sit down to a stack of bills. More revenue could certainly make it easier to meet your financial obligations completely and on time. But so can QuickBooks Online.

Sometimes you get behind on your payables because you’re simply not keeping track of them carefully enough. Maybe you don’t know that a specific vendor is willing to work with you on your payment schedule. Or you aren’t aware of how much money you have committed to your other vendors, and you make purchases that you really can’t afford.

QuickBooks Online can assist in all these scenarios. It has built-in tools that can help you:

- Know how much money you’ve already committed,

- Keep a close watch on current and future bills, and,

- Simplify the process of tracking and paying bills.

QuickBooks Online can help you track bills, so you pay on time and don’t get into unmanageable debt.

Know How Much You Owe

This is something you should be doing regularly anyway, but certainly before you make a buying decision that will either be a major expense or which will incur a debt, both of which will increase your payables. QuickBooks Online can answer these questions for you:

What does my cash flow look like over the coming months? Cash flow is something we haven’t discussed much in this column. It’s complicated. QuickBooks Online has both a Cash Flow Dashboard and a report called Statement of Cash Flows. If you wat to explore this concept, please contact us to set up a session or two.

Have I been running a profit consistently? Profitability is different from cash flow. Run the Profit and Loss report (Reports | Business Overview). Use the customization options at the top to look at the previous several months.

Am I willing to go into debt for this purchase? Check the balances on your bank and credit card accounts (Dashboard | Home). If you don’t have enough cash now, are you comfortable increasing the balance on a credit card?

Keep Your Bills Organized and Accessible

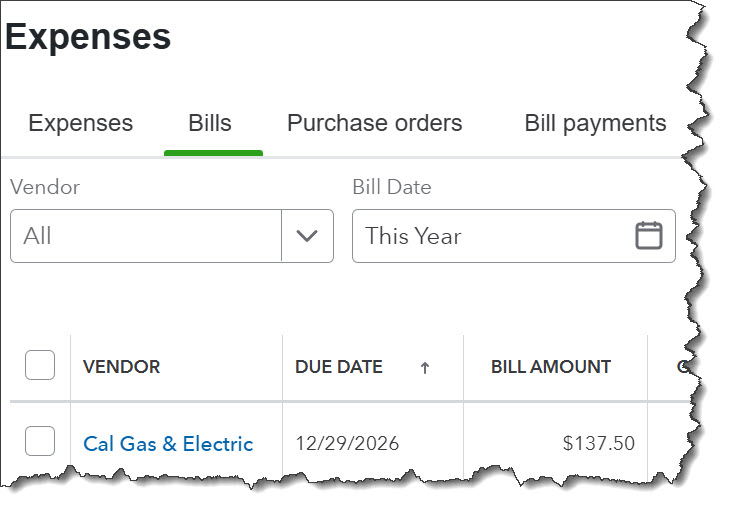

You can manually enter bills to display them in a register for easy viewing and related actions.

If you’re still tracking bills and expenses manually, you know that it’s difficult-to-impossible to know how much you owe and to whom, when payments are due, and whether specific bills have been paid. You may have paper bills and expense receipts scattered around your office, and notes on your calendar reminding you when they’re due. And when you pay a batch of bills, you hope that the bank balance in your paper checkbook register is accurate.

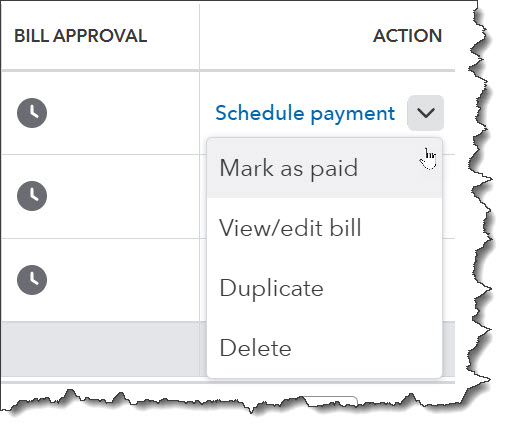

QuickBooks Online devotes an entire section to payables. Click Expenses in the toolbar to see the types of transactions (Expenses, Bills, etc.), records (Vendors, Contractors), and other tools (Mileage, 1099 filings) covered there. Once you’ve created vendor records, you can enter details for individual or recurring bills and mark them as paid once you’ve sent a check. All bills—paid and unpaid—appear in registers, so you can easily see their status.

Reports provide a great way for you to see what’s happening with your payables in real time. Click Reports in the toolbar, then scroll down to What you owe. By customizing and creating specific reports, you can find out, for example:

- What you owe currently on bills and whether you’re past due on any (Accounts payable aging summary),

- Which bills you’ve paid (Bill Payment List),

- Which bills you haven’t paid (Unpaid Bills), and,

- Your unpaid bills and the total amount you owe each vendor (Vendor Balance Detail).

An Automated Bill Payment Option

QuickBooks Online is very good at automating bookkeeping tasks, and bill pay is one of the areas where it excels. QuickBooks Bill Pay Basic is now included in your QuickBooks Online subscription. You can have bills sent to your own unique email address or upload invoices. The site will pull details from these documents and create pre-filled bills. This isn’t a perfect process. It depends in part on the quality and layout of the original paper form.

Once a bill is ready, you can pay it using ACH (bank payment) or have Intuit send a paper check. You get five free ACH payments every month. After that, you’ll pay $.50 each. Paper checks cost $1.50 to process and mail. QuickBooks Bill Pay also offers two paid plans with fewer limits and advanced features.

Big Changes Are Coming

You may have noticed that the QuickBooks user interface has been changing recently, including the introduction of new AI Agents. If you’ve been confused by this, you should know that Intuit will begin rolling out a new look and navigation system starting this month. Not everyone will have access to it immediately, so it may be a while before you see it. We hope this will be a positive change for you. We’ll go over the new user interface in detail in a future column.

In the meantime, we’re available to consult with you on any issues you’re having with your accounts payable. QuickBooks Online’s tools aren’t overly difficult to use, but you may want our help understanding the overall flow of money through your company file and how you can use the site’s bill tracking and paying features to keep your vendors happy.