Recent News & Blog / Managing company credit cards in QuickBooks

November 18, 2019

QuickBooks provides an efficient and effective way to manage and reconcile your business credit cards. There are different ways to record your credit card transactions however the method outlined is preferred and will help to:

- Ensure all transactions/expenses are recorded

- Track the liability for any balance carried

- Reconcile your credit card statement each month

Credit Card transactions can be entered as they occur, when the statement is received or even downloaded. Either method will allow you to reconcile the account just as a bank account would be.

Quick Tip:

You can download credit card transactions directly from your credit card company and save time. QuickBooks reviews your previously entered transactions to avoid duplication. You can do so by selecting the “Download Card Charges” from the top of the Credit Card Purchase/Charge screen.

Note: The first time you select the “Download Card Charges” you will be directed to the “Online Banking Setup Wizard.”

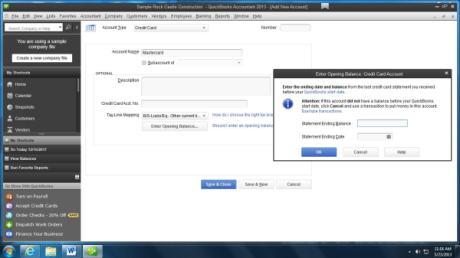

The first step is setting your credit card accounts correctly in the Chart of Accounts:

- Go to: Lists > Chart of Accounts

- In the bottom left corner select Account > New

- Select “Credit Card” as the account type and click continue

- Enter the account name and the opening balance. (This should be the ending balance from your last credit card statement)

- Save and close

Once you have your credit card accounts set up, you can begin to enter credit card charges either as they occur or when the statement is received.

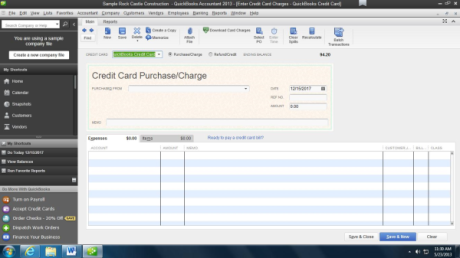

To enter transactions:

- Banking > Enter Credit Card Charges

- At the Credit Card Purchase/Charge window

- Select the appropriate credit card

- Enter the appropriate information

You will note that the Credit Card Purchase/Charge window is very similar to the Write Checks window. You also have the option to select whether you are entering a purchase/charge or a refund/credit.

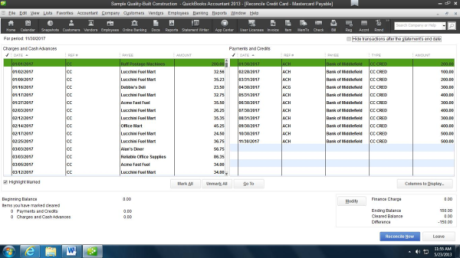

Now that you have your transactions entered and have received your monthly credit card statement you will want to reconcile your credit card account. This process is completed in the same manner as reconciling a bank account.

- Go To: Banking > Reconcile

- Select the Credit Card Account in the Account field

- Enter the statement ending date

- Enter the statement ending balance

- Enter any finance charges and specify the appropriate date and corresponding expense account

- Click Continue

In this screen, charges appear on the left side, payments and credits on the right. Check off all transactions that appear on your credit card statement. You can enter any missing transactions simply clicking on Banking>Enter credit card charges (this can be done while remaining in the reconciliation). After entering any missing transactions, select Save and Close and you will be taken back to the reconciliation screen. The transactions you just entered will appear.

After marking all the transactions, you should make sure you have a 0.00 difference in the bottom right hand side of the screen and click “Reconcile.” QuickBooks will ask you if you would like to create a check to pay now or if you would prefer to create a bill from which to pay later. Select the option you prefer. You can also choose to pay the balance in full or only pay a portion of the balance.

Note: Be sure to choose your credit card account as the expense account for the payment. This will reduce the liability account by your payment.

Now that you have completed the reconciliation, your balance sheet should reflect the correct credit card liability and can once again, begin entering transactions.

Click here to learn more about QuickBooks Consulting Services