Recent News & Blog / QuickBooks Desktop Payroll - direct deposit fee update

December 11, 2023

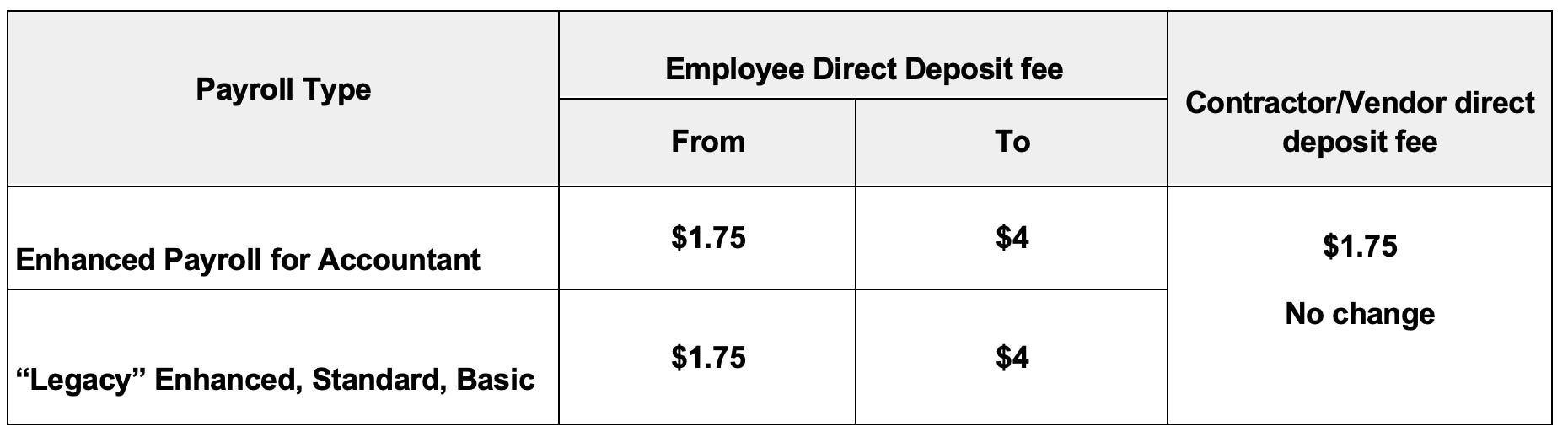

If you are using QuickBooks Desktop Payroll for employee direct deposits, we would like to notify you of an important pricing change that QuickBooks will be implementing. Beginning on or after January 8, 2024, the fee for each employee payroll direct deposit processed through Intuit QuickBooks will increase to $4.

The following Payroll plans are not impacted by the change:

- “Non-legacy” Basic, Enhanced, and Assisted Payroll plans that have monthly per employee fees.

- Payroll that is included in the QuickBooks Enterprise Gold, Platinum, and Diamond plans.

- Direct deposit (bill payments) fees to contractors/vendors paid through Desktop Payroll.

Have you considered switching to QuickBooks Online?

Switch to QuickBooks Online Payroll for anywhere anytime access, and automated payroll tax filing and payments. From securing discount wholesale pricing to getting you set up in QuickBooks Online, our team is ready to assist. Contact us using the form below to learn more today!