Cash or accrual accounting: What’s best for tax purposes?

Many businesses have a choice between using the cash or accrual method of accounting for tax purposes. The cash method often provides significant tax benefits for businesses that qualify, but some may be better off using the accrual method. The CPAs and business tax advisors at SEK can help you evaluate the most beneficial tax approach.

Are you unfairly burdened by a spouse’s tax errors? You may qualify for “innocent spouse relief”

Navigating tax law complexities can be difficult, especially when faced with an unexpected tax bill due to the errors of a spouse or ex-spouse. In some cases, spouses are eligible for “innocent spouse relief.” If you’re interested in trying to obtain relief, paperwork must be filed and deadlines must be met. The process is challenging. The CPAs and tax advisors at SEK can assist you with the details.

Understanding taxes on real estate gains

Let’s say you own real estate that has been held for more than one year and is sold for a taxable gain. You may expect to pay the standard 15% or 20% federal income tax rate that usually applies to long-term capital gains from assets. However, some real estate gains can be taxed at higher rates due to depreciation deductions. The calculations are complex. The CPAs and tax advisors at SEK will handle them when we prepare your tax return.

A power of appointment can provide estate planning flexibility

After your death, events may transpire that you couldn’t have reasonably foreseen. To provide some flexibility, consider including a trust provision in your estate plan that provides a designated beneficiary a power of appointment over the trust’s property. The holder of the power of appointment can have the discretion to change distributions from the trust. Contact the CPAs and estate planning advisors at SEK for details.

Making your nonprofit board retreat rejuvenating — and productive

Not-for-profit board members tend to be busy people. So even if your budget is tight, try to organize periodic retreats that enable members to clear their minds and focus on your organization’s most pressing issues. Make sure you write a thorough agenda and schedule adequate time for brainstorming, as well as breaks to have fun as a group. Contact the business advisors at SEK if you need more financial tips.

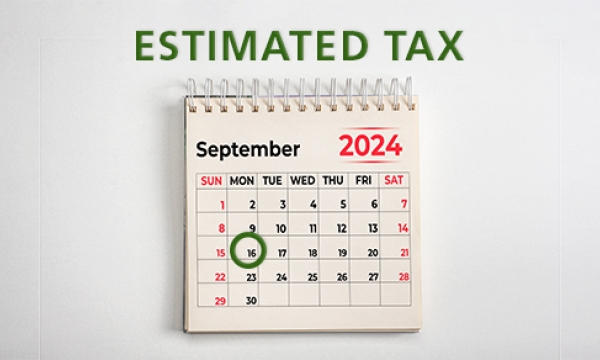

Do you owe estimated taxes? If so, when is the next one due?

Federal estimated tax payments ensure that certain individuals pay their taxes throughout the year. If you don’t pay enough during the year through withholding and estimated payments, you may be liable for a penalty on top of the tax due. Contact the CPAs and tax advisors at SEK with your tax questions.

The possible tax landscape for businesses in the future

The upcoming elections may significantly alter the tax landscape of U.S. businesses. The reason has to do with provisions of the Tax Cuts and Jobs Act (TCJA) that are set to expire on Dec. 31, 2025. The CPAs and business tax advisors at SEK will keep you informed so stay tuned or contact us with your tax questions.

Nonprofits: Don’t let myths and self-doubt thwart your capital campaign plan

Don't let unfounded fears prevent your organization from pursuing its philanthropic goals. Just make sure you plan carefully, choose the right leaders and communicate your goals forcefully, and you can execute a rewarding capital campaign. Contact the CPAs and business advisors at SEK for help analyzing the financial aspects of a capital campaign.

4 tips for managing inventory in QuickBooks Online

Running out of products? Stocking too many? How QuickBooks Online can help solve both problems.

The tax implications of disability income benefits

Many Americans receive private disability income. How is it taxed? It depends on who paid for the tax treatment depends on who paid for the insurance coverage. Contact the CPAs and tax advisors at SEK for help with your tax questions.