Nonprofits: Beware of shady investment advisors

If you have an endowment or stash of operating reserves, a shady investment advisor could pose as a legitimate and experienced expert and trick you into handing it over. Here’s how to avoid this type of scheme, as well as how to maintain your nonprofit’s image as a responsible financial steward. Contact our nonprofit advisors with questions.

When the problem is the manager

In a small business, each employee plays an important role, including the managers. But what happens when a manager, who may also be a high performer or long-time team member, is the source of workplace issues? It's a tough situation, but it’s not uncommon.

Digital assets and taxes: What you need to know

Curious how your crypto, NFTs or stablecoins could impact your taxes? We break down what the IRS expects and how to stay compliant when reporting digital asset transactions. Contact our tax experts for help.

Have you made arrangements for your pets in your estate plan?

Including your pets in your estate plan ensures they’ll continue to receive care if something happens to you. Unless you arrange for their care and support after your death, they’ll go to the residuary beneficiary in your will. Here's how to address your pets in your estate plan.

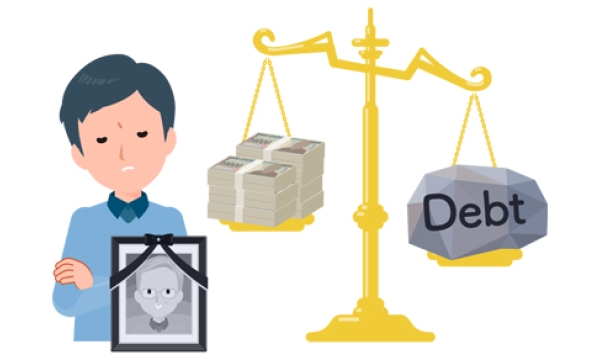

After a person dies, his or her debts live on

It’s important to realize that a person’s debt doesn’t just vanish after his or her death. An estate’s executor or beneficiaries generally aren’t personally liable for any debt. The estate itself is liable for the deceased’s debt. This is true regardless of whether the estate goes through probate or a revocable trust is used to avoid probate. Contact our estate planning advisors for details.

When corporate sponsorships raise UBIT issues

At a time when every dollar counts, your nonprofit doesn’t want to end up with a UBIT bill. So be careful when accepting corporate sponsorships because some can be risky. Read here or contact our nonprofit advisors for helpful tips.

Being a gig worker comes with tax consequences

The gig economy offers flexibility, autonomy and a way to earn income, but it also comes with tax obligations that can catch many workers off guard. Whether you’re driving for a rideshare service, delivering food, selling products online, or offering local services like pet walking, it’s crucial to understand the tax implications of gig work to stay compliant and avoid costly surprises. Contact our tax advisors with questions.

Hiring independent contractors? Make sure they’re properly classified

Many businesses turn to independent contractors to help manage costs, especially during times of staffing shortages and inflation. If you’re among them, ensuring these workers are properly classified for federal tax purposes is crucial. Misclassifying employees as independent contractors can result in expensive consequences such as audits, back taxes, penalties and even lawsuits. Our business advisors can also consult with you on this topic.

The tax rules for legal awards and settlements: What recipients should know

If you receive a court award or out-of-court settlement, do you have to pay tax on it? The answer is … it depends. The way a settlement is structured can significantly affect your tax liability, making professional guidance essential. We can help you understand the rules, ensure proper reporting and potentially reduce your tax burden. Contact our tax advisors to discuss how a court award or out-of-court settlement may affect your taxes.

Crowdfunding for your nonprofit can be easy, but the tax implications may not be

Crowdfunding campaigns can help nonprofits raise money for individuals or causes. But it’s critical that your organization and its supporters understand the tax implications. Contact our nonprofit advisors for more information.