Recent News & Blog / Business Tax

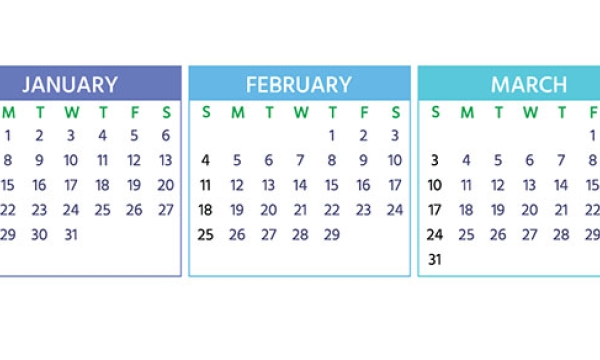

2024 Q1 tax calendar: Key deadlines for businesses and other employers

Here are a few key tax-related deadlines for businesses during the first quarter of 2024. Contact the CPA's and financial advisors at SEK to learn more about filing requirements and ensure you’re meeting all applicable deadlines.

2024 Payroll Tax Bulletin

The IRS recently released the 2024 payroll tax rates, which we have summarized in a bulletin that contains the following:

2024 Rates & Dates

The IRS recently released the 2024 rates and dates, which includes the following:

Updated Maryland minimum wage and overtime law

Effective January 1, 2024, Maryland State's employee minimum wage is increasing to $15 per hour for all employers, regardless of size. In contrast to the 2023 state rate hike, the rate remains consistent regardless of whether a company has more or fewer than 15 employees.

A company car is a valuable perk but don’t forget about taxes

One of the most appreciated fringe benefits for owners and employees of small businesses is the use of a company car. This perk results in tax deductions for the employer and tax breaks for the owners and employees using the cars. Our CPA's and Tax Advisors can help keep you in compliance with the rules. Give our accounting firm a call today for more tax tips and financial advice.

New FinCEN reporting requirement: beneficial ownership information reporting under the Corporate Transparency Act

The Corporate Transparency Act (“CTA”) was enacted January 1, 2021, as part of the National Defense Authorization Act, representing the most significant reformation of the Bank Secrecy Act and related anti–money laundering rules since the U.S. Patriot Act.

When holiday gifts and parties are deductible or taxable

The holiday season is a great time for businesses to show their appreciation for employees and customers by giving them gifts or hosting holiday parties. Before you begin shopping or sending out invitations, though, it’s a good idea to find out whether the expense is tax deductible and whether it’s taxable to the recipient. Here’s a brief review of the rules.

Key 2024 inflation-adjusted tax parameters for small businesses and their owners

The IRS recently announced various inflation-adjusted federal income tax amounts. Here’s a rundown of the amounts that are most likely to affect small businesses and their owners. Rates and brackets

A cost segregation study may cut taxes and boost cash flow

Is your business depreciating over 30 years the entire cost of constructing the building that houses your enterprise? If so, you should consider a cost segregation study. It may allow you to accelerate depreciation deductions on certain items, thereby reducing taxes and boosting cash flow.

2023 Year-End Year-Round Tax Planning Guide

At SEK, we are dedicated to helping you maximize your income through a variety of tax-saving strategies. We are excited to share our 2023 Year-End Year-Round Tax Planning Guide, which includes: