Recent News & Blog / Business Tax

Separating your business from its real estate

Does your business own real estate titled under the business’s name? With long-term tax, liability and estate planning advantages, separating real estate ownership from the business may be a better choice. Contact the CPAs and business tax advisors at SEK to learn more.

Is your business required to report employee health coverage?

Certain employers are required to report information about employees’ health coverage. Is your business required to comply? Read this article to find out or contact the CPAs and business advisors at SEK.

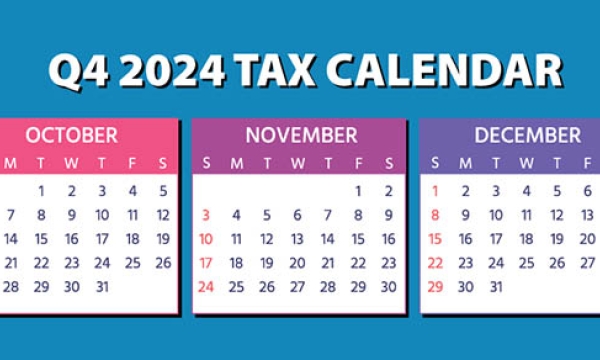

2024 Q4 tax calendar: Key deadlines for businesses and other employers

Mark your calendar: It’s time for businesses to start thinking about the fourth quarter 2024 tax filing deadlines.

Maryland Department of Labor issues new guidance on Wage Transparency and Paystub Notice obligations

Maryland will have two significant laws go into effect on October 1, 2024. These laws will require employers to provide employees with more upfront information about a job's wage and benefits, as well as, more transparency on paystubs. Read here to ensure your business is compliant.

Reasons an LLC might be the ideal choice for your small to medium-size business

For many businesses, a limited liability company (LLC) is an enticing choice. It can be structured to resemble a corporation for owner liability purposes and a partnership for federal tax purposes. This may provide the owners with several advantages. Contact the CPAs and business tax advisors at SEK to discuss whether an LLC is the best option for you and your business.

Year-end tax planning ideas for your small business

It’s time to take proactive steps that may help lower your business’s taxes for 2024 and 2025. Eligible businesses also may be able to defer income or accelerate deductions to keep income under certain thresholds to claim a qualified business income deduction. Contact the CPAs and business tax advisors at SEK to customize a tax plan for your business.

Comparison of Harris and Trump tax policy proposals

Presidential nominees Kamala Harris (D) and Donald Trump (R) are floating proposals ahead of what will be a consequential year for tax, with key provisions from the GOP’s 2017 tax overhaul (Public Law 115-97

Navigating tax complexities: Craft partnership agreements and LLC operating agreements with precision

Often multi-member LLCs that are treated as partnerships for tax purposes. A major reason is that these entities offer federal income tax advantages. They also must follow special, sometimes complicated federal tax rules. Contact the CPAs and business tax advisors at SEK to be involved in the creation process.

Cash or accrual accounting: What’s best for tax purposes?

Many businesses have a choice between using the cash or accrual method of accounting for tax purposes. The cash method often provides significant tax benefits for businesses that qualify, but some may be better off using the accrual method. The CPAs and business tax advisors at SEK can help you evaluate the most beneficial tax approach.

Understanding taxes on real estate gains

Let’s say you own real estate that has been held for more than one year and is sold for a taxable gain. You may expect to pay the standard 15% or 20% federal income tax rate that usually applies to long-term capital gains from assets. However, some real estate gains can be taxed at higher rates due to depreciation deductions. The calculations are complex. The CPAs and tax advisors at SEK will handle them when we prepare your tax return.