Recent News & Blog / Business Tax

Divorcing as a business owner? Don’t let taxes derail your settlement

Divorce is stressful under any circumstances, but for business owners, the process can be even more complicated.

Lower your self-employment tax bill by switching to an S corporation

If you own an unincorporated small business, you may be frustrated with high self-employment (SE) tax bills. One way to lower your SE tax liability is to convert your business to an S corporation.

A tax guide to choosing the right business entity

One of the most critical decisions entrepreneurs make when starting or restructuring a business is choosing the right entity type.

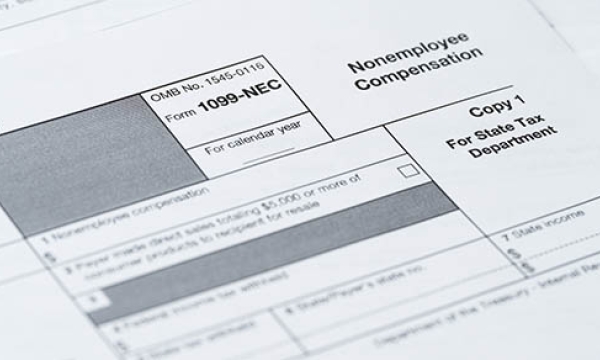

The new law includes a game-changer for business payment reporting

The One, Big Beautiful Bill Act (OBBBA) contains a major overhaul to an outdated IRS requirement. Beginning with payments made in 2026, the new law raises the threshold for information reporting on certain business payments from $600 to $2,000.

What you still need to know about the alternative minimum tax after the new law

The alternative minimum tax (AMT) is a separate federal income tax system that bears some resemblance to the regular federal income tax system.

The QBI deduction and what’s new in the One, Big, Beautiful Bill Act

The qualified business income (QBI) deduction, which became effective in 2018, is a significant tax benefit for many business owners. It allows eligible taxpayers to deduct up to 20% of QBI, not to exceed 20% of taxable income.

Unlocking Wealth: How the One Big Beautiful Bill and 100% Bonus Depreciation Supercharges Real Estate and Short-Term Rental Investments

The One Big Beautiful Bill, signed into law in July 2025, has permanently reinstated 100% bonus depreciation—a powerful tax incentive that’s reshaping investment strategies across the country. Read here what this could mean for real estate professionals.

What the One, Big, Beautiful Bill Act (OBBBA) could mean for individuals and businesses

As 2025 began, taxpayers were facing uncertainty as several key tax provisions were set to expire at year's end. That changed on July 4, when President Trump signed the One, Big, Beautiful Bill Act (OBBBA) into law. The OBBBA brings a mix of changes that could impact both individuals and businesses. First, we’ll explore eight key areas that may affect you and your family - then we'll review 10 areas that may impact your business.

The IRS recently announced 2026 amounts for Health Savings Accounts

Health Savings Account (HSA) update for employers: If your business offers HSAs, the IRS recently released the 2026 inflation-adjusted amounts. Here they are, along with the benefits of HSAs. Contact our business advisors with questions about HSAs.

Take advantage of the rehabilitation tax credit when altering or adding to business space

Thinking of investing in, or restoring, a historic building for your business? The federal tax code may reward you with a tax credit. Here’s how it works. Contact our business tax advisors with questions.