Bridging the gap between budgeting and risk management

At many companies, a wide gap exists between the budgeting process and risk management. Failing to consider major threats could leave you vulnerable to high-impact hits to your budget if one or more of these dangers materialize.

Parental priorities: How to choose a guardian for your child

If you have minor children, arguably the most important estate planning decision you need to make is choosing a guardian for them should the unthinkable occur. If you haven’t yet made this decision, formalize your choice as soon as possible. Contact the estate planning advisors at SEK for your estate planning needs.

The tax implications if your business engages in environmental cleanup

If your company faces the need to “remediate” or clean up environmental contamination, the money you spend can be deductible on your tax return as ordinary and necessary business expenses.

Managing company credit cards in QuickBooks

QuickBooks provides an efficient and effective way to manage and reconcile your business credit cards. There are different ways to record your credit card transactions however the method outlined is preferred and will help to:

Close-up on pushdown accounting for M&As

Change-in-control events — like merger and acquisition (M&A) transactions — don’t happen every day. If you’re currently in the market to merge with or buy a business, you might not be aware of updated financial reporting guidance that took effect in November 2014.

Flex plan: In an unpredictable estate planning environment, flexibility is key

The Tax Cuts and Jobs Act (TCJA) made only one change to the federal gift and estate tax regime, but it was a big one. It more than doubled the combined gift and estate tax exemption, as well as the generation-skipping transfer (GST) tax exemption. This change is only temporary, however.

GAAP vs. tax-basis: Which is right for your business?

Most businesses report financial performance using U.S. Generally Accepted Accounting Principles (GAAP). But the income-tax-basis format can save time and money for some private companies.

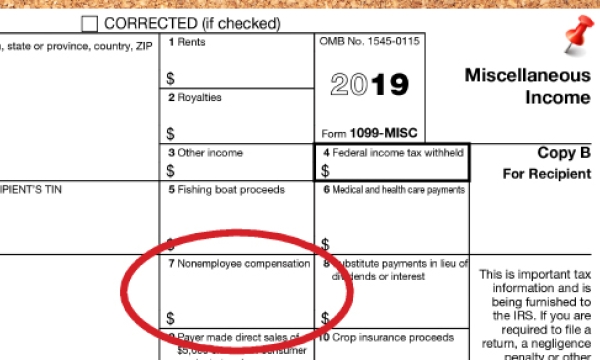

Small businesses: Get ready for your 1099-MISC reporting requirements

A month after the new year begins, your business may be required to comply with rules to report amounts paid to independent contractors, vendors and others. You may have to send 1099-MISC forms to those whom you pay non-employee compensation, as well as file copies with the IRS.

Setting up sales taxes in QuickBooks, part 2

Now that you have your sales taxes set up, you’ll be able to use them in transactions and reports.

Depreciation and cost recovery rules: 2019 and later

The Tax Cuts and Jobs Act of 2017 (TCJA) brought with it some changes and updates to Depreciation rules. SEK’s tax department has created this one page quick reference guide to help answer some of the most common Depreciation questions we receive.