Auditing grant compliance

Has your organization received any public or private grants to fund its growth? Grants sometimes require an independent audit by a qualified accounting firm. Here’s what grant recipients should know to help facilitate matters and ensure compliance at all levels.

5 important questions to ask about paid parental leave

Under federal law, there’s no mandate for an employer to offer compensated time off to mothers and fathers following the birth or adoption of a child. But a few states have mandatory paid parental leave laws on the books, and it’s a topic that still gets a fair amount of news coverage.

Control how your charitable gifts are used by adding restrictions

If philanthropy is an important part of your estate planning legacy, consider taking steps to ensure that your donations are used to fulfill your intended charitable purposes. Outright gifts can be risky, especially large donations that will benefit a charity over a long period of time.

Putting together the succession planning and retirement planning puzzle

Everyone needs to plan for retirement. But as a business owner, you face a distinctive challenge in that you must save for your golden years while also creating, updating and eventually executing a succession plan.

Creating statement charges in QuickBooks

There’s more than one way to bill customers for your products and services. A statement charge is one of them.

Offering group term life insurance through a cafeteria plan

Many employers wish to offer group term life insurance as a fringe benefit but find the premiums unaffordable. Under such circumstances, you could provide the coverage and have employees pay the premiums pretax through an existing cafeteria plan. Just be sure you understand the tax impact.

Expenses that teachers can and can’t deduct on their tax returns

As teachers head back for a new school year, they often pay for various expenses for which they don’t receive reimbursement. Fortunately, they may be able to deduct them on their tax returns. However, there are limits on this special deduction, and some expenses can’t be written off.

Expanded 529 plans offer unique estate planning benefits

If you’re putting aside money for college or other educational expenses, consider a tax-advantaged 529 savings plan. Also known as “college savings plans,” 529 plans were expanded by the Tax Cuts and Jobs Act (TCJA) to cover elementary and secondary school expenses as well.

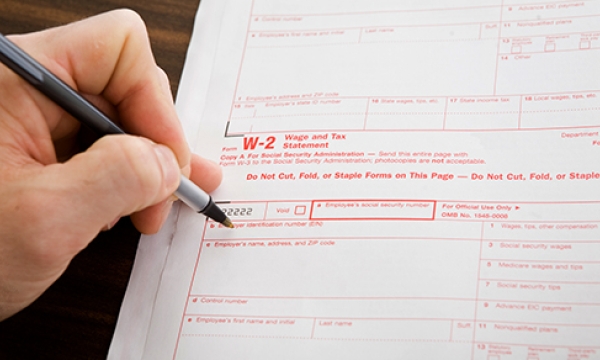

Employers can truncate SSNs on employees’ W-2s

The IRS recently issued final regulations that permit employers to voluntarily truncate employee Social Security Numbers (SSNs) on copies of Forms W-2 furnished to employees. The purpose of the regs is to aid employers’ efforts in protecting workers from identity theft.

Reporting discontinued operations

Financial reporting generally focuses on the results of continuing operations. But sometimes businesses sell (or retire) a product line, asset group or another component. In certain situations, such a disposal should be reported as a discontinued operation under U.S.