Owning Real Estate in Multiple States Can Negatively Affect Beneficiaries

A vacation home, rental property, or future retirement residence may play an important role in your long-term plans. However, if you hold properties across multiple states, it can create estate planning issues that can be easily overlooked.

How Many Directors Does Your Nonprofit Really Need?

For nonprofit boards, 2026 looks to be a year of difficult questions. How do you encourage donor confidence amid economic uncertainty? Should you embrace artificial intelligence (AI) technology?

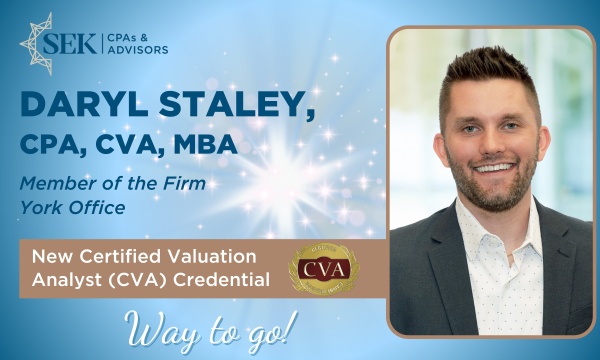

SEK Member, Daryl Staley, Earns Valuation Credential

SEK, CPAs & Advisors is pleased to announce that Daryl Staley, CPA, CVA, MBA, has earned the Certified Valuation Analyst (CVA) credential throug

8 Beginning of the Year Money-Saving Tips

At the beginning of the year, many of us are holding ourselves accountable to the goals we’ve set for the year, with one of the most common goals being to save more money.

There’s Still Time to Set Up a SEP and Reduce Your 2025 Taxes

If you own a business or are self-employed and haven’t already set up a tax-advantaged retirement plan, consider establishing one before you file your 2025 tax return.

Considering Splitting Gifts with Your Spouse? Here’s What to Consider

The gift tax annual exclusion allows you to transfer up to $19,000 (for 2026) per beneficiary gift-tax-free, without tapping your $15 million (for 2026) lifetime gift and estate tax exemption.

4 Internal Red Flags That May Indicate Shaky Nonprofit Health

With cost-of-living concerns, interest rates, and federal funding cuts continuing to be prominent in the headlines, many nonprofit leaders are understandably focused on external economic pressures.

Tax Filing FAQs for Individuals

The IRS is opening the filing season for 2025 individual income tax returns on January 26.

Is Your Business Ready for the Tax Deadline That’s on Groundhog Day This Year?

Normally businesses must furnish certain information returns to workers and submit them to the federal government by January 31, but this year, that date falls on a Saturday, so the deadline is the next business day, which happens to be Groundhog Day: February

3 Steps to Help Ensure That Your Estate Plan Won’t be Challenged After Your Death

It’s not uncommon for family members to contest a loved one’s will or challenge other estate planning documents.