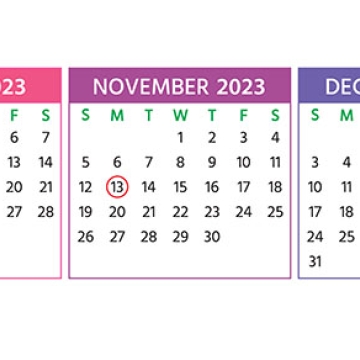

2023 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you.

Trust and internal controls can coexist in your nonprofit

Within a period of just a month, a Minnesota woman was charged with skimming more than $300,000 from her animal rescue charity, a Florida man was charged with multiple felonies for running several charities for his personal benefit, and a New York man was sentenced to 18 months in prison for defr

What are the tax implications of winning money or valuable prizes?

If you gamble or buy lottery tickets and you’re lucky enough to win, congratulations! After you celebrate, be aware that there are tax consequences attached to your good fortune. Winning at gambling

Why nonprofits should be transparent about compensation

More and more U.S. workers are calling for “pay transparency,” and not-for-profit employers need to listen — and act. Pay transparency is the idea that employers should openly share their compensation policies and practices with job candidates, current employees and the public.

Build a better nonprofit board with term limits

Are your not-for-profit’s board members subject to term limits? If not, you might want to consider implementing what’s widely considered a best practice.

Selling your home for a big profit? Here are the tax rules

Many homeowners across the country have seen their home values increase in recent years. According to the National Association of Realtors, the median price of existing homes sold in July of 2023 rose 1.9% over July of 2022 after a couple years of much higher increases.

FASB finalizes new crypto standard in record time

On September 6, the Financial Accounting Standards Board (FASB) unanimously voted to finalize new accounting rules on cryptocurrency assets — less than five months after the proposed standard was issued for public comment. Here’s what companies that hold these assets should know.

Investment swings: What’s the tax impact?

If your investments have fluctuated wildly this year, you may have already recognized some significant gains and losses. But nothing is decided tax-wise until year end when the final results of your trades will reveal your 2023 tax situation.

Evaluate whether a Health Savings Account is beneficial to you

With the escalating cost of health care, many people are looking for a more cost-effective way to pay for it. For eligible individuals, a Health Savings Account (HSA) offers a tax-favorable way to set aside funds (or have an employer do so) to meet future medical needs.

Avoiding probate: How to do it (and why)

Few estate planning subjects are as misunderstood as probate. But circumventing the probate process is usually a good idea, and several tools are available to help you do just that. Why should you avoid it?